Calculating your net worth chapter 1 lesson 4 – Calculating your net worth is a crucial step in understanding your financial well-being. It provides a snapshot of your financial situation and serves as a foundation for making informed decisions about your future. This comprehensive guide will walk you through the process of calculating your net worth, interpreting its significance, and developing strategies to build long-term wealth.

Calculating Your Net Worth: Calculating Your Net Worth Chapter 1 Lesson 4

Calculating your net worth is a crucial step in understanding your financial health and making informed financial decisions. It provides a snapshot of your financial position and serves as a foundation for financial planning and goal setting.

1. Defining Net Worth, Calculating your net worth chapter 1 lesson 4

Net worth is the difference between your assets and liabilities. Assets are anything you own that has value, while liabilities are debts or obligations you owe.

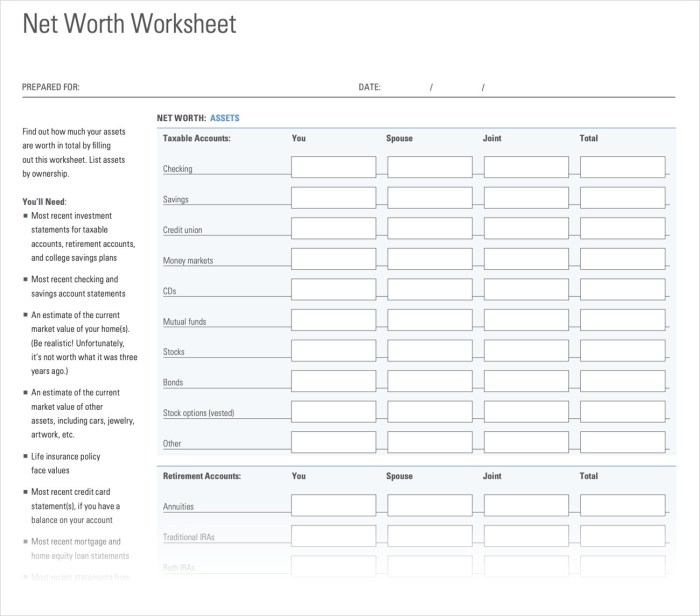

2. Calculating Assets

Common assets include:

- Cash and cash equivalents

- Investments (stocks, bonds, mutual funds)

- Real estate (primary residence, rental properties)

- Vehicles

- Personal property (jewelry, collectibles)

To value your assets, use market value or fair market value, which is the estimated price you could sell the asset for in the current market.

3. Calculating Liabilities

Common liabilities include:

- Credit card debt

- Student loans

- Mortgages

- Personal loans

- Taxes owed

To determine your liabilities, gather your statements or contact your creditors to obtain the outstanding balances and interest rates.

4. Net Worth Formula

The formula for calculating net worth is:

Net Worth = Assets

Liabilities

For example, if you have assets worth $100,000 and liabilities of $20,000, your net worth would be $80,000.

5. Interpreting Net Worth

Net worth is a key indicator of your financial health. A positive net worth indicates that you have more assets than liabilities, while a negative net worth indicates that you owe more than you own.

Net worth can impact loan approvals, investment strategies, and retirement planning.

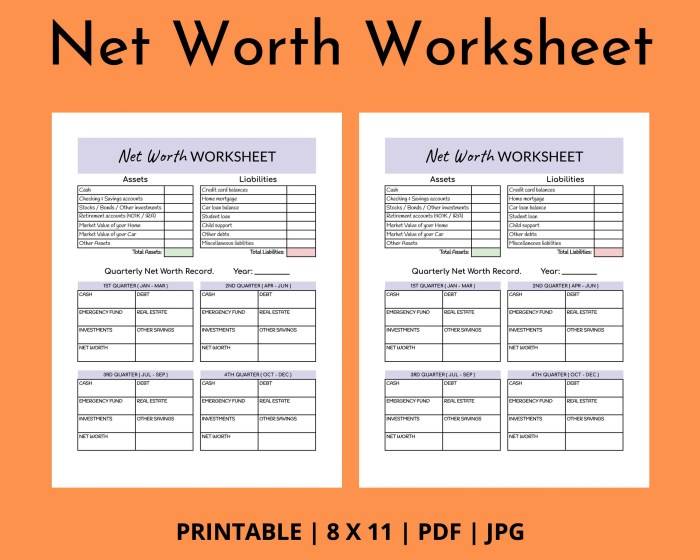

6. Tracking Net Worth

It’s important to track your net worth regularly to monitor your financial progress and make adjustments as needed.

Use spreadsheets, financial software, or online tools to stay organized and ensure accurate calculations.

7. Building Net Worth

Strategies for building net worth include:

- Increasing income

- Reducing expenses

- Investing wisely

Budgeting, saving, and investing are essential components of long-term wealth accumulation.

Question Bank

What is the difference between assets and liabilities?

Assets are anything you own that has value, while liabilities are debts or obligations you owe. Assets increase your net worth, while liabilities decrease it.

How often should I calculate my net worth?

It is recommended to calculate your net worth at least once a year, or more frequently if you have significant changes in your financial situation.

What are some strategies for increasing my net worth?

Increasing your income, reducing your expenses, and investing wisely are all effective ways to build your net worth over time.