As lily is completing her 1040 form – As Lily Completes Her 1040 Form: A Comprehensive Guide to Navigating Tax Season, delves into the intricacies of tax preparation, providing a roadmap for individuals seeking to optimize their tax returns and minimize their tax liability. This comprehensive guide empowers taxpayers with the knowledge and strategies necessary to navigate the complexities of the tax code, ensuring accuracy, maximizing deductions and credits, and avoiding common pitfalls.

Throughout this guide, we will explore Lily’s financial situation, identifying tax deductions and credits applicable to her circumstances. We will delve into the intricacies of reporting income and expenses, unraveling the complexities of tax forms and schedules. By addressing common errors and pitfalls, we aim to equip taxpayers with the tools to minimize mistakes and ensure the accuracy of their tax returns.

Overview of Lily’s Situation: As Lily Is Completing Her 1040 Form

Lily is a single mother with two young children. She works as a nurse and earns an annual salary of $60,000. She also receives $5,000 in child support payments from her ex-husband. Lily is completing her 1040 form for the first time and needs guidance on how to accurately report her income, deductions, and dependents.

Identifying Tax Deductions and Credits

Deductions

Lily can claim several deductions on her tax return, including the standard deduction, itemized deductions, and dependent deductions. The standard deduction is a set amount that reduces taxable income. For 2023, the standard deduction is $13,850 for single filers. Itemized deductions are expenses that can be deducted from taxable income, such as mortgage interest, property taxes, and charitable contributions.

Dependent deductions allow Lily to claim a deduction for each qualifying child.

Credits

Lily may also be eligible for tax credits, which are dollar-for-dollar reductions in taxes owed. Common tax credits include the child tax credit, earned income tax credit, and education credits. The child tax credit provides a credit for each qualifying child.

The earned income tax credit is a refundable credit for low- and moderate-income working individuals and families. Education credits can help reduce the cost of higher education expenses.

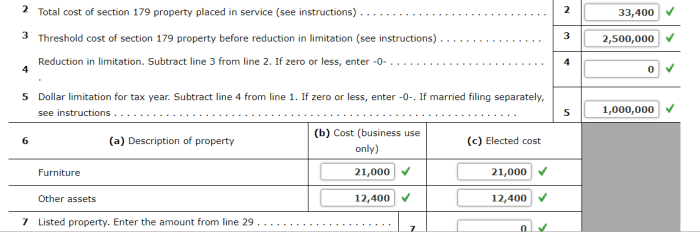

Reporting Income and Expenses

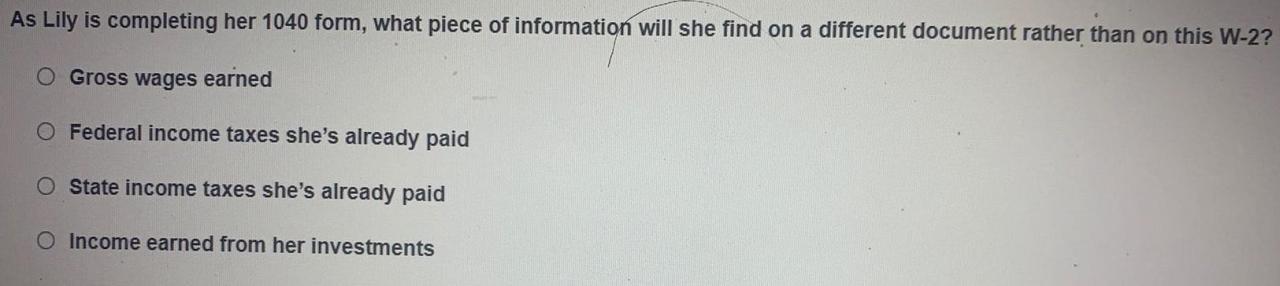

Lily must accurately report all of her income and expenses on her 1040 form. Income includes wages, salaries, tips, and self-employment income. Expenses can include business expenses, itemized deductions, and other expenses that are deductible on the tax return.

Income

Lily’s income includes her salary, child support payments, and any other taxable income. She must report the total amount of her income on Line 1 of the 1040 form.

Expenses, As lily is completing her 1040 form

Lily can choose to take the standard deduction or itemize her deductions. If she itemizes her deductions, she must list the expenses on Schedule A of the 1040 form. Common itemized deductions include mortgage interest, property taxes, and charitable contributions.

Adjusted Gross Income

Lily’s adjusted gross income (AGI) is her total income minus her standard deduction or itemized deductions. AGI is used to calculate her taxable income and determine her eligibility for certain tax credits and deductions.

Navigating Tax Forms and Schedules

The 1040 form is the main tax return form used by individuals to file their federal income taxes. The 1040 form is accompanied by several schedules that provide additional information about the taxpayer’s income, deductions, and credits.

Schedule A: Itemized Deductions

Schedule A is used to itemize deductions that are not included in the standard deduction. Common itemized deductions include mortgage interest, property taxes, and charitable contributions.

Schedule B: Interest and Dividends

Schedule B is used to report interest and dividend income. This includes interest earned on savings accounts, CDs, and bonds, as well as dividends received from stocks and mutual funds.

Schedule C: Profit or Loss from Business

Schedule C is used to report income and expenses from self-employment activities. This includes income from businesses, farms, and freelance work.

Common Errors and Pitfalls

There are several common errors and pitfalls that taxpayers should avoid when completing their 1040 form. These include:

- Math errors

- Incorrectly claiming deductions or credits

- Failing to report all income

- Filing the wrong tax form

Taxpayers can minimize errors by carefully reviewing their tax return before filing. They should also make sure to use the correct tax forms and schedules and follow the instructions carefully.

Filing Options and Deadlines

Taxpayers have several options for filing their 1040 form. They can file electronically, by mail, or through a tax preparer. The deadline for filing taxes is April 15th. However, taxpayers can file for an extension until October 15th.

Electronic Filing

Electronic filing is the fastest and most accurate way to file taxes. Taxpayers can file electronically using tax software or through the IRS website.

Filing by Mail

Taxpayers can also file their taxes by mail. They should mail their tax return to the IRS address for their state.

Tax Preparers

Taxpayers who need help completing their tax return can hire a tax preparer. Tax preparers can help taxpayers gather their documents, calculate their taxes, and file their tax return.

Tax-Saving Strategies

There are several tax-saving strategies that taxpayers can consider to reduce their tax liability. These strategies include:

- Contributing to a retirement account

- Taking advantage of deductions and credits

- Planning for capital gains and losses

- Investing in tax-advantaged accounts

Taxpayers should consult with a tax professional to determine which tax-saving strategies are right for them.

Commonly Asked Questions

What are the most common tax deductions and credits?

Common tax deductions include mortgage interest, charitable contributions, and state and local taxes. Common tax credits include the child tax credit and the earned income tax credit.

How can I maximize my tax deductions and credits?

To maximize your tax deductions and credits, it is important to keep accurate records of your expenses and income. You should also research available deductions and credits to determine which ones apply to your situation.

What are the consequences of making mistakes on my tax return?

Making mistakes on your tax return can result in penalties and interest charges. In some cases, you may also be subject to an audit.

What are the different filing options available to me?

You can file your tax return electronically, by mail, or through a tax professional. Electronic filing is the fastest and most accurate method of filing.